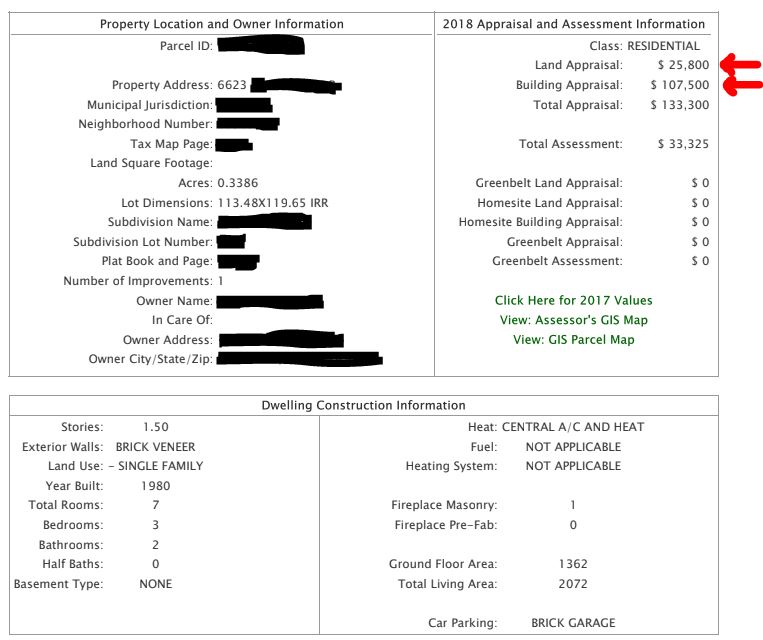

real estate tax shelter example

For example for a. Tax shelters can range from investments or.

7 Great Tax Benefits Of Investing In Real Estate Passive Income

Here are nine of the best tax shelters you can use to reduce your tax burden.

. As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property. This is mainly due to its generous tax benefits. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

Tax Lien Examples - Learn the facts of investing in tax lien certificates. States counties or municipalities can impose RETs. Real estate tax shelter example.

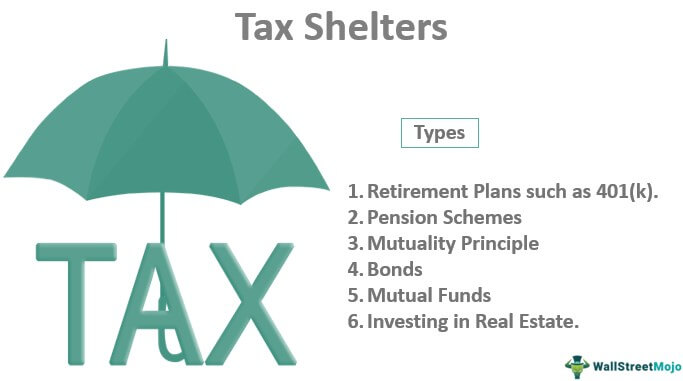

A tax shelter is a method used by businesses and individuals to reduce their tax liabilities. How Does an Abusive Tax Shelter Work. Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges.

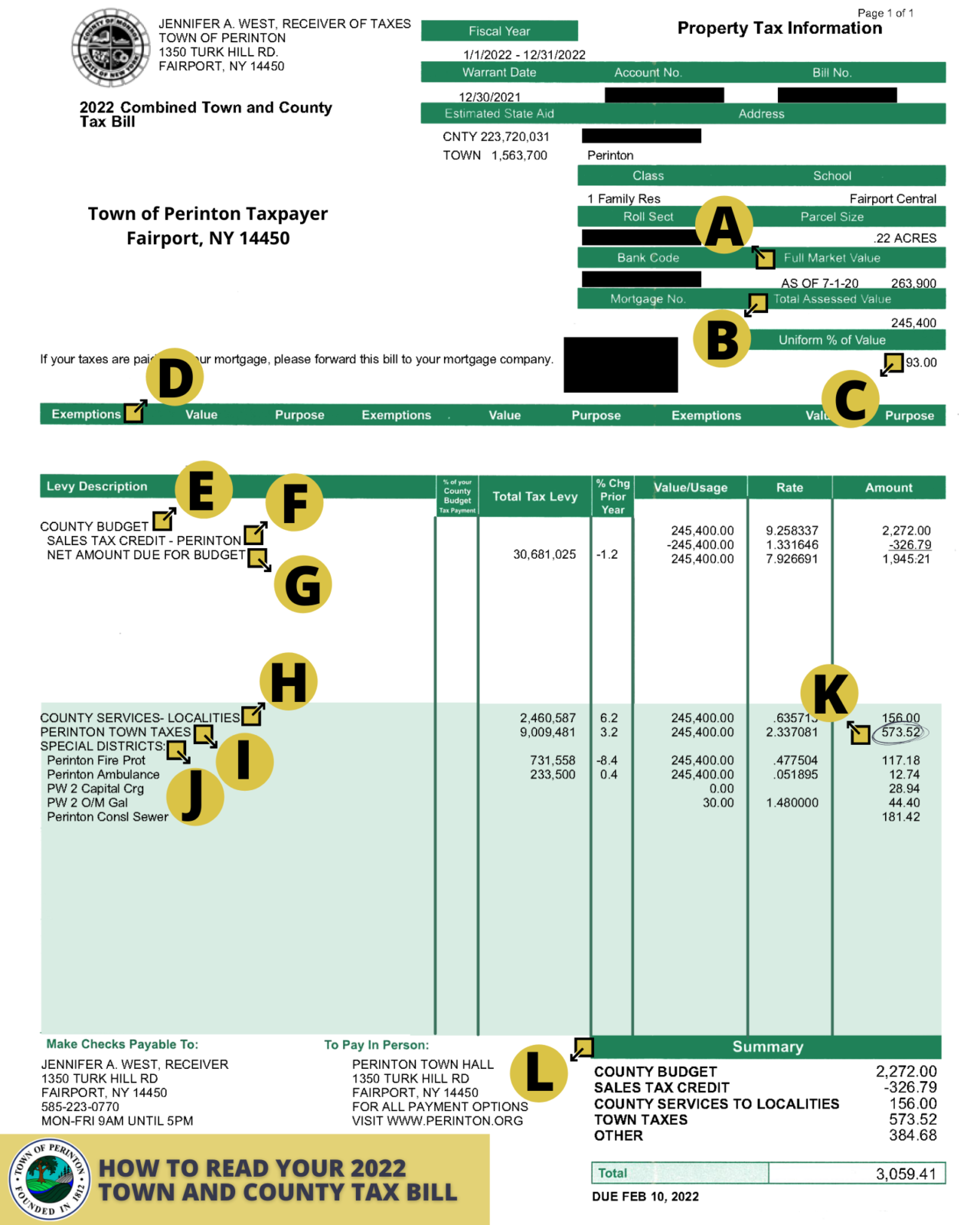

Tax shelters work by reducing your taxable income thereby reducing your taxes. PROPERTY TAX DUE DATES. HOW TO PAY PROPERTY TAXES.

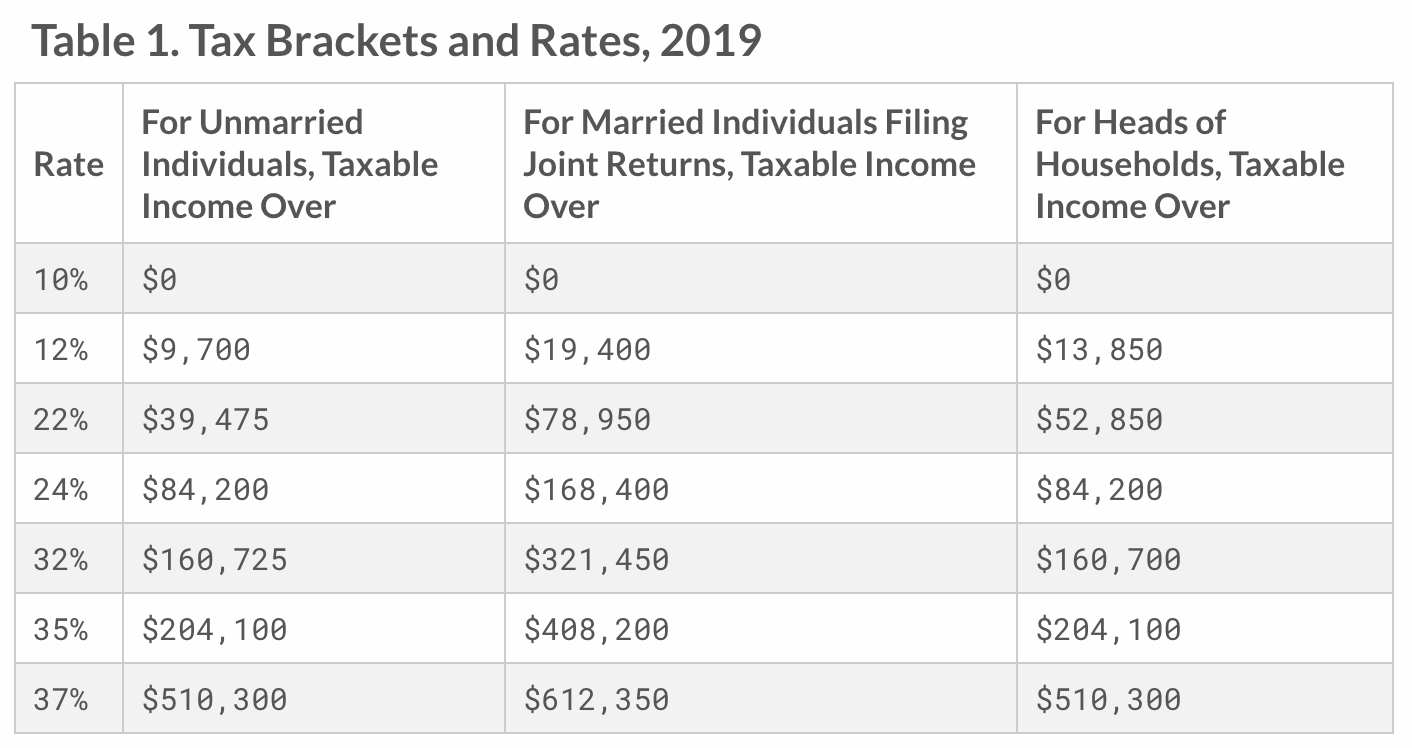

Key Takeaways A tax shelter is a place to legally store assets so that. A 401 k or other type of tax-deferred retirement account like an IRA. December 31 of the pretax year ie the year prior to the calendar tax year or with the municipal tax collector from January 1 through December 31 of the calendar tax year.

In 2022 employees can make up to 20500 in deductible contributions to a 401 k with workers age 50 and older entitled to deduct an additional 6500 in catch-up. You are eligible for a property tax deduction or a property tax credit only if. In Person - The Tax Collectors.

Set Up a Retirement Account. 23 Returns Last Year. An abusive tax shelter is an investment strategy that illegally shields assets from tax liability.

Historically real estate has proved to be a significant tax shelter. Access business information offers and more - THE REAL YELLOW PAGES. Compare Real Estate Taxes in Edison NJ.

As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to another.

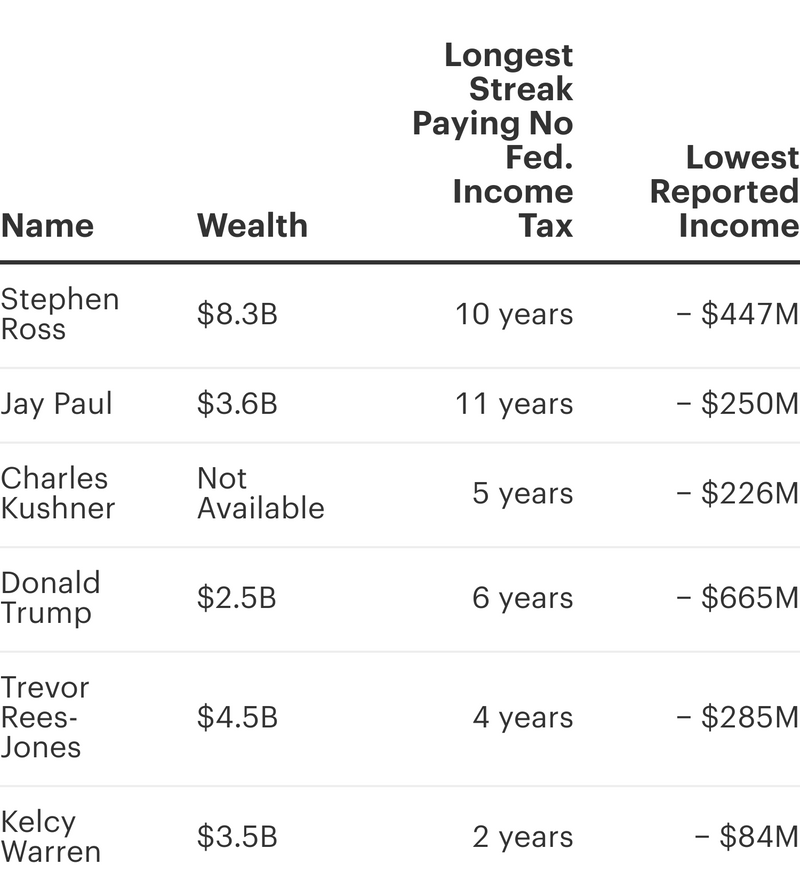

These Real Estate And Oil Tycoons Avoided Paying Taxes For Years Propublica

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Property Management Accounting A Complete Starter Guide

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Tax Shelters Definition Types Examples Of Tax Shelter

Cash Accounting Method Unlocked Dallas Business Income Tax Services

The 2021 Ultimate Guide To Irs Schedule E For Real Estate Investors

Tax Shelters For Real Estate Investors Morris Invest

5 Tax Deductions For Rental Property Bankrate

The True Cost Of Global Tax Havens Imf F D

11 Ways The Wealthy And Corporations Will Game The New Tax Law Center For American Progress

To Reform Stepped Up Basis At Death Focus On Tax Shelter Recharge

Can Rental Property Loss Offset Ordinary Income White Coat Investor

3 Unbelievable Real Estate Tax Shelters Of The Rich

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

How To Read Your Town County Tax Bill Town Of Perinton

The Hidden Wealth Of Nations The Scourge Of Tax Havens Zucman Gabriel Fagan Teresa Lavender Piketty Thomas 9780226245423 Amazon Com Books

These Real Estate And Oil Tycoons Avoided Paying Taxes For Years Propublica

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital